Prescription Drug Rebate Facts and Sources

Understanding Pharmacy Benefit Managers (PBMs) is crucial for patients, healthcare stakeholders, and lawmakers alike. PBMs wield significant influence over prescription drug pricing, formulary decisions, and patient access to medications. By negotiating discounts with drug manufacturers and determining which medications are covered, PBM decisions directly impact patients’ out-of-pocket costs and overall healthcare experience.

PBMs are companies that manage prescription drug benefits on behalf of health insurers, Medicare Part D drug plans, large employers, and other payers. PBMs operate in the middle of the distribution chain for prescription drugs by:

- Developing and maintaining lists, or formularies, of covered medications on behalf of health insurers

- Influencing which drugs individuals are able to access and use, and determine patients’ out-of-pocket costs using their purchasing power to negotiate rebates and discounts from drug manufacturers

As the state and national discussion about PBMs continues, it will be important to engage in a balanced discussion about the issue. As patients and policymakers aim to grasp the complexities of healthcare costs and the implications on access, understanding PBMs can lead to better policies. The following resources aim to break down the nuances and factors of the current PBM structure and track the latest reports, data and news related to PBMs.

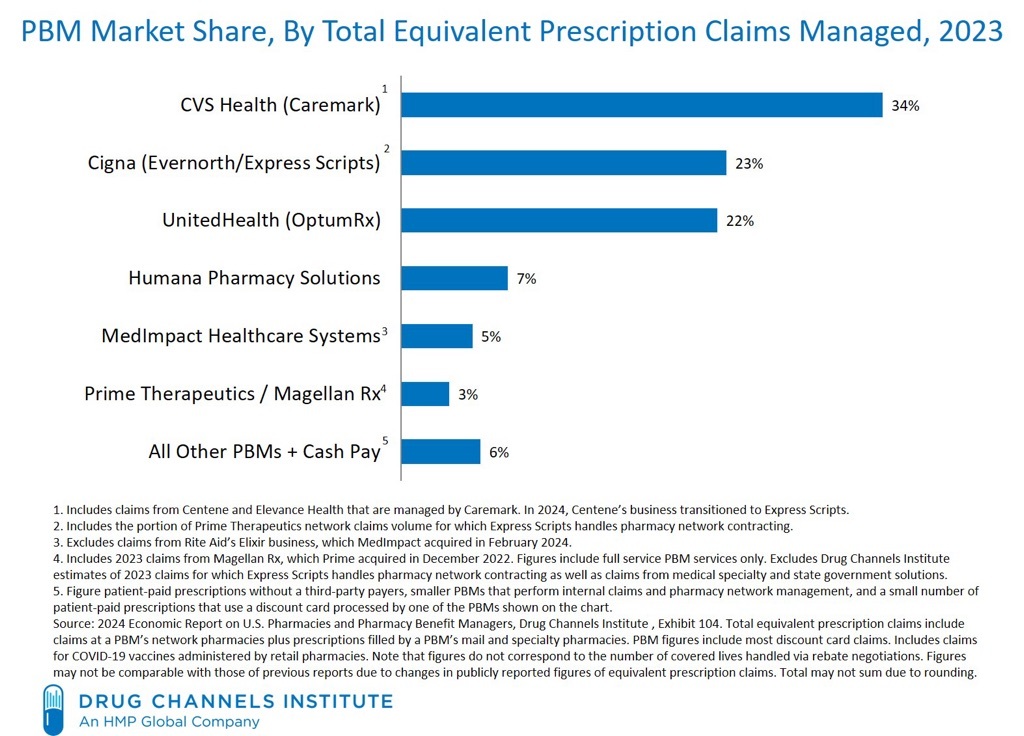

The following graphics provide a comprehensive overview of PBM market share and relationships between insurers and PBMs

Column: Pharmacy middlemen claim to keep prescription prices low. In fact, they’ve cost consumers billions

By Michael Hiltzik

July 11, 2024

In 2022, an executive of a big pharmacy middleman firm acknowledged the noxious reality of its business model: It was designed to massively overcharge customers by steering them to its affiliated or “preferred” pharmacies or its home delivery subsidiary. Referring to a generic version of Gleevec, a leukemia drug taken by nearly 200,000 patients, the executive noted in an internal memo that “you can get the drug at a non-preferred pharmacy (Costco) for $97, at Walgreens (preferred) for $9000, and at preferred home delivery for $19,200…. We’ve created plan designs to aggressively steer customers to home delivery where the drug cost is ~200 times higher.”

Recap | Patients Over Profits: California’s Opportunity To Reform PBMs And Reduce Prescription Costs

California Partnership for Access to Treatment

July 10, 2024

On Wednesday, July 10, the California Partnership for Access to Treatment and California Access Coalition co-hosted Patients Over Profits: California’s Opportunity to Reform PBMs and Reduce Prescription Costs. We were thrilled to bring together such a strong mix of experts to discuss all things pharmacy middlemen, including California state efforts to hold them accountable through SB 873 (Bradford) and SB 966 (Wiener), Washington state efforts through E2SSB 5213, as well as updates from Maryland and New York.

Mail-Order Drugs Were Supposed to Keep Costs Down. It’s Doing the Opposite

By Jared S. Hopkins

June 25, 2024

A key tool that businesses have counted on to keep a lid on employees’ drug spending—filling workers’ prescriptions by mail—is now driving up their costs. Unity Care NW, a nonprofit health clinic in Washington state, forecasts the cost of medical and drug benefits for its 365 employees and their family members will increase this year by 25% to more than $3 million. A big reason: Drugs delivered by mail are costing multiples more than those picked up at a store counter.

The Opaque Industry Secretly Inflating Prices for Prescription Drugs

Rebecca Robbins and

June 21, 2024

Americans are paying too much for prescription drugs. It is a common, longstanding complaint. And the culprits seem obvious: Drug companies. Insurers. A dysfunctional federal government. But there is another collection of powerful forces that often escape attention, because they operate in the bowels of the health care system and cloak themselves in such opacity and complexity that many people don’t even realize they exist.

Roundtable on Lowering Healthcare Costs and Bringing Transparency to Prescription Drug Middlemen

The White House

March 4, 2024

The Evolving Landscape of the PBM Industry

American Health Law Association

September 15, 2023

A Brief Look at Current Debates About Pharmacy Benefit Managers

Brookings Institute

September 7, 2023

Matthew Fielder, Loren Adler and Richard G. Frank

Pharmacy benefit managers (PBMs) are entities that administer prescription drug insurance benefits. Their key functions include negotiating prices with drug manufacturers and pharmacies, establishing drug formularies and pharmacy networks, and processing drug claims. PBMs are currently attracting considerable critical attention from policymakers

How the prescription drug supply chain is killing local pharmacies

PBS NewsHour

July 28, 2023

Pharmacy Benefit Managers

NAIC – Center for Insurance Policy and Research

June 1, 2023

Pharmacy Benefit Managers (PBMs) are third party companies that function as intermediaries between insurance providers and pharmaceutical manufacturers. PBMs create formularies, negotiate rebates (discounts paid by a drug manufacturer to a PBM) with manufacturers, process claims, create pharmacy networks, review drug utilization, and occasionally manage mail-order specialty pharmacies. In light of rising health care costs, the role of PBMs are being reviewed due to the cost of prescription drugs and the effects on consumers. The cost of insulin and EpiPens has been the focus of much of the news coverage, with patients being forced to ration medicine when they cannot afford copays.

FTC Launches Inquiry Into Prescription Drug Middlemen Industry

Federal Trade Commission

June 7, 2022

The Federal Trade Commission announced today that it will launch an inquiry into the prescription drug middleman industry, requiring the six largest pharmacy benefit managers to provide information and records regarding their business practices. The agency’s inquiry will scrutinize the impact of vertically integrated pharmacy benefit managers on the access and affordability of prescription drugs. As part of this inquiry, the FTC will send compulsory orders to CVS Caremark; Express Scripts, Inc.; OptumRx, Inc.; Humana Inc.; Prime Therapeutics LLC; and MedImpact Healthcare Systems, Inc.

Department of Managed Health Care – Prescription Drug Cost Transparency Report

California Department of Managed Health Care

December 27, 2021

This report looks at the impact of the cost of prescription drugs on health plan premiums and compares this data across the reporting years. The DMHC considered the total volume of prescription drugs prescribed by health plans and the total cost paid by health plans for these drugs, on both an aggregate spending level and a per member per month (PMPM) basis and compared the annualized data. The DMHC also analyzed how the 25 most frequently prescribed drugs, the 25 most costly drugs, and the 25 drugs with the highest year-over-year increase in total annual spending impacted health plan premiums over the course of the last four years.

Measuring the Impact of Point of Sale Rebates on the Commercial Health Insurance Market

Milliman

July 2021

There has been heightened interest in understanding the dynamics, challenges, and impacts of passing pharmacy rebates directly to members at the point of sale (POS). This report explores how applying rebates in this manner would affect both member premiums and cost sharing for an average member as well as hypothetical patients with selected chronic conditions.

Examining the Factors Driving the Rising Cost of a Century Old Drug

United States Senate – Senate Finance Committee

January 14, 2021

Diabetes is among the most pervasive, deadly, and costly diseases in the United States. According to the Centers for Disease Control and Prevention (CDC), diabetes is the 7th leading cause of death in the U.S. and more than 34 million people in the country live with the disease.

The Association Between Drug Rebates and List Prices

USC – Leonard Schaeffer Center for Health Policy & Economics

February 11, 2020

Growing divergence between pharmaceutical list and net prices suggest that manufacturer rebates to pharmacy benefit managers (PBMs) and other distribution system intermediaries may play a role in rising drug prices. We analyze new data on list and estimated net prices of U.S. branded pharmaceuticals, finding that, on average, a $1 increase in rebates is associated with a $1.17 increase in list prices. The positive and near 1:1 relationship remains when single-source and multi-source drugs are considered separately (although the effect is smaller and less statistically significant for multi-source drugs), and when drugs with high Medicaid share are excluded.

How Drug Prices Work

The Wall Street Journal

May 30, 2019